|

The following is an update on the California home insurance situation from the non-profit consumer organization, United Policyholders, (“UP”). UP is working hard to help California property owners stay insured and financially protected despite unprecedented availability and affordability challenges in the current marketplace. Reducing wildfire risk is more important than ever for suburban and rural property owners. We believe the situation will eventually improve, but here’s where we are in the here and now. Below you’ll find links to shopping guidance and updates on a few of our related workstreams. Bottom line: As soon as you get a non-renewal notice, start shopping, and don’t go on rumors. Dig for options, be patient. Insurers are still in the CA market but with strict limits/quotas on how many policies they’ll sell in given areas. Your fallback is the Fair Plan, flawed as it may be, it’s coverage. If an insurance agent tells you that your only option is the Fair Plan, we recommend contacting at least one other agent who may lead you to other potential options. We encourage you to share these resources with your neighbors ·Updated shopping tips: www.uphelp.org/buying-tips/updated-home-insurance-shopping-tips-2023/ · What to do if you’ve been non-renewed: www.uphelp.org/droppedCA ·Resources for reducing your wildfire risk and increasing your home’s insurability: www.uphelp.org/WRAP ·Options through the California Fair Plan (CFP): www.uphelp.org/CFP. NOTE: If your home meets the IBHS Wildfire Prepared Home or Safer From Wildfires standards, you are eligible for a Fair Plan premium discount of up to 14.5%. Big Picture: https://uphelp.org/bach-talk-an-insured-future-depends-on-bold-public-private-innovation/

0 Comments

The goal of the Wildfire Adapted program is to help property owners learn how to reduce fire-related risks. The program provides defensible space and structure hardening assessments, community workshops, and rebate incentives to help property owners understand, prioritize, and complete risk-reduction projects.

Check out Sonoma County Wildfire Adapted (permitsonoma.org) for more information and to see if your property is eligible. From District 5 Supervisor - Lynda Hopkins - 1/4/2023

PREP DAY We are all closely watching the forecasts for the coming storms. With the ground saturated from prior rain and the rivers and creeks already high, flooding is likely — both from creeks overflowing their banks, as well as from the main stem of the Russian River. In addition to flooding, saturated soils will allow for trees to topple more easily. We are anticipating that high winds will blow down trees and impact power lines, leading to potentially widespread power outages. Travel may be difficult, especially for high profile vehicles. Plan to stay safe at home during the peak of the storm if at all possible. (More tips on this below.) And please prepare today! Today is our last dry window for a while. It’s a perfect day to grab some of the sand bags we’ve made available at the Forestville fire station, Monte Rio fire station, or Sonoma Landworks in Guerneville. It’s also a good day to check your generator, or to double-check to make sure you’ve got enough food and medication. STORM PROGRESS The storm is expected to begin with a warmer front involving light precipitation Wednesday morning. As the day progresses, southerly winds will pick up, with gusts between 40 and 60 mph — and stronger gusts in higher ridges and peaks. Per today’s National Weather Service Bay Area Forecast Discussion, “These winds combined with already saturated soils will likely result in downed trees/limbs causing isolated to scattered power outages as well as potential property damage… Rainfall through midday Wednesday will be greatest in the coastal ranges.” Mid to late Wednesday, the cold front and atmospheric river should arrive in the North Bay, bringing with it heavy rainfall. Per NWS, “confidence remains high for widespread substantial rainfall over the coastal ranges on the order of 3.00"-6.00" with isolated amounts up to 8.00" through Thursday. Meanwhile, most urban areas will pick up 1.00"-3.00" with higher amounts of up to 5.00" in the North Bay… forecast rainfall over already saturated soils will result in widespread flooding impacts region-wide. Of greatest concern will be flooding of rivers, creeks, streams, and other low-lying and flood-prone locations. This will also result in extensive street flooding in portions of the Bay Area and Central Coast. Additionally, these conditions will also lead to an increased threat for widespread shallow landslides.” RUSSIAN RIVER FLOOD RISK The latest NOAA forecast as of 3PM today has the Russian River cresting late Thursday night/early Friday morning at 35.4’ in Guerneville. This is more than three feet above flood stage (which is 32’ in Guerneville). Of perhaps greater concern is next week, with the possibility of two additional atmospheric rivers coming on the heels of this large storm. While models are much less accurate for next week, preliminary forecasts suggest that the Russian River may crest near 39’ in Guerneville on Monday. BIGGEST RISKS We’ve all been through some pretty big floods together, and we’ve always pulled together and pulled through! And I know we will this time. But this is the first time in recent memory that we’re expecting flood conditions accompanied by winds that could exceed 60mph. Public safety professionals are recommending that residents avoid being outside in forested areas and around trees and branches during the height of the windstorm. If possible, remain in the lower levels of your home during the windstorm, and avoid windows. Use caution if you must drive. And remember — turn around, don’t drown! We *will* experience flooded roadways from this storm. If you wind up cut off from home by a creek flowing over a road, call a friend. Don’t try to drive through a flooded roadway and endanger your life — as well as the lives of first responders. Stay safe, y’all. If you need anything please email our team at [email protected]. Resources The County and the D5 Team are working to make available resources to address possible flooding. Your preparations make a difference. Today is the one dry day - so use this time while you have it. In rural West County, sand and sandbags are available at the following locations: · Monte Rio Fire Department: 9870 Main Street, Monte Rio, CA 95462 · Forestville Fire Department: 6554 Mirabel Road, Forestville, CA 95436 · Sonoma Landworks - 15950 River Rd, Guerneville, CA (this location opened up today thanks to coordination between Sonoma Landworks, Fire Safe Guerneville, Sonoma County Public Infrastructure and your Fifth District team) Santa Rosa and Sebastopol locations: · Santa Rosa: www.srcity.org/rainready · Sebastopol: https://ci.sebastopol.ca.us/Article/Sandbags-Available-to-Sebastopol-Residents Want to help neighbors by pre-filling sandbags for those that can't do it alone? Just drop in at the Forestville Fire Station at 6554 Mirabel Rd, Forestville, CA 95436 People arriving there for bags would be grateful to those that prefill and stack some bags. Details: · No set hours, go whenever it’s convenient, but know that there’s no cover to protect you from the elements, and it’s not lit. The fire station itself is a 24-7 operation, but they’re doing other tasks. · You probably want 2 people there together because it’s much easier to do the work with more than one person. · They have a shovel there, but it may be helpful to bring your own. · It’s muddy and you may want gloves and boots, generally footwear and clothes that can get dirty. Trailers and RV's in low lying areas: we are working together with multiple possible sites to finalize safe parking locations for trailers and RVs in low lying areas. We will send out final locations tomorrow (Wednesday) am. County of Sonoma Department of Emergency Management and Fire Departments are preparing to respond to emergent situations caused by the flood. The Emergency Operations Center has been activated and will be working together on helping meet community needs. The Fire departments have had coordination meetings to prepare. We are working with all these folks to support resources in the area and will be sending out updates regularly here. Our friends over at Sonoma Fire caution "tell people to stay off the roads as much as possible. Falling limbs and rock slides are a danger and we don't want to have cars stuck or flooded that block the way of emergency response." So for your own safety as well as others, batten down the hatches and stay home if you can until this series of storms passes. Flood Preparation information from SocoEmergency.org If You are Under a Flood Warning, Find Safe Shelter Right Away · Do not walk, swim, or drive through flood waters. Turn Around, Don’t Drown! · Just 6 inches of moving water can knock you down, and one foot of moving water can sweep your vehicle away. · Stay off of bridges over fast-moving water. · Determine how best to protect yourself based on the type of flooding. · Evacuate if told to do so. · Move to higher ground or a higher floor. · Stay where you are. Preparing before Flood· Sign up for SoCo Alert · Know types of flood risk in your area. Visit FEMA’s Flood Map Service Center for information. · If flash flooding is a risk in your location, then monitor potential signs, such as heavy rain. · Learn and practice evacuation routes, shelter in place plans, and flash flood response. · Make sure your Go Bag is ready in case you have to leave immediately, or if water and power services are turned · Keep in mind each family member’s specific needs, including medication. Don’t forget the needs of pets. · Obtain extra batteries and charging devices for phones and other critical equipment in case of power outages. · Purchase or renew a flood insurance policy. It typically takes up to 30 days for a policy to go into effect and can protect the life you’ve built. Homeowner’s policies do not cover flooding. Get flood coverage under the National Flood Insurance Program (NFIP) · Keep important documents in a waterproof container and create a password-protected digital copies. · Protect your property. Move valuables to higher levels. Declutter drains and gutters. Install check valves. Consider a sump pump with a battery. · Check in with neighbors who may need assistance getting ready and evacuating. During a Flood· Depending on where you are, as well as the impact and the warning time of flooding, go to the safe location that you previously identified. · Listen to EAS, NOAA Weather Radio, or local alerting systems for current emergency information and instructions. · Do not walk, swim, or drive through flood waters. Turn Around. Don’t Drown! · If your vehicle is trapped in rapidly moving water, then stay inside. If water is rising inside the vehicle, then seek refuge on the roof. · If trapped in a building, then go to its highest level. Do not climb into a closed attic. You may become trapped by rising floodwater. Go on the roof only if necessary. Once there, signal for help. On June 19th the County of Sonoma, Department of Emergency Management will conduct community-specific evacuation exercises for Occidental and Camp Meeker. Residents are encouraged to participate.These exercises will provide public safety departments an opportunity to practice alerting an area using the Hi-Lo sirens, test the County alerting system, and residents can practice evacuating and leaving their neighborhood area. To SIGN UP and for MORE INFORMATION please visit http://bit.ly/SoCoEvac

For the up-beat and positive insurance professional with personal and/or commercial insurance experience this is an opportunity to work remotely while building a lucrative career with a successful and flexible company. We are a small, established insurance agency located in Occidental. We have served the West Sonoma County and Northern California for more than 40 years and have a reputation for delivering outstanding customer service.

In this growth-oriented role you will provide quality service to our clients and cross sell within the existing book of business. This position will serve as the day-to-day liaison between Open Door Insurance, our partners / vendors and our customers. Daily servicing of clients will include addressing various coverage issues, contract analysis, exposure analysis, routine coverage questions, problem solving, renewal management, preparation of formal proposals, checking and binding policies as well as new business development through cross and up-selling. Our friendly and flexible environment provides many opportunities for learning and advancement. General Client Management

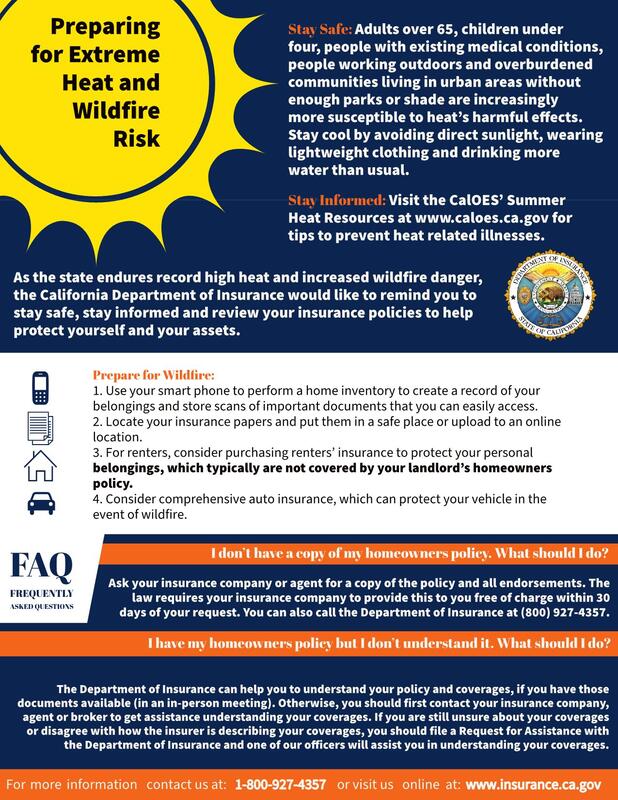

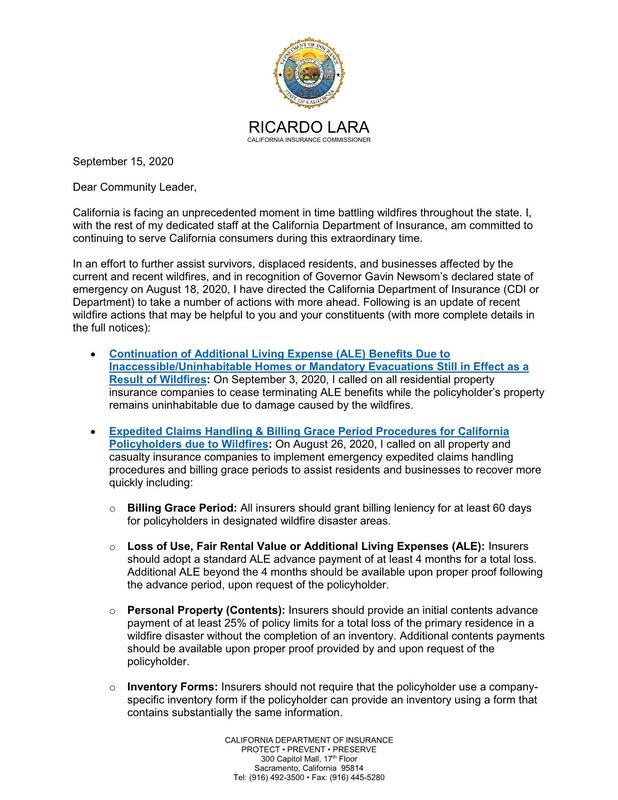

About Us Open Door Insurance Services (formerly Gaffney Insurance) has been serving Sonoma County and Northern California since 1978 and we have an intimate knowledge of the area and the uniqueness of its landscape, population, properties and insurance challenges. We provide an unprecedented level of insurance expertise for personal, business, specialty and non-profit insurance. Our friendly team can quickly and accurately assess your needs, evaluate the offerings from multiple, top-rated insurance carriers, and present you with a custom-built plan to solve your insurance needs at a reasonable price. Our decades of experience and high-level of customer satisfaction fuels our continued success. We don’t just work in Sonoma’s West County, we live and play here. Wildfire evacuees may be eligible for cost reimbursement from their insurance company: http://www.insurance.ca.gov/0400-news/0100-press-releases/2020/release074-2020.cfm Resources to Help Recent Wildfire Victims: https://www.insurance.ca.gov/01-consumers/140-catastrophes/WildfireResources.cfm Evacuation Checklist for Policyholders: https://www.insurance.ca.gov/01-consumers/140-catastrophes/EvacuationChecklist.cfm Evacuation Checklist and Home Inventory Guide App: iPhone (https://tinyurl.com/appleevacuationchecklist) Android (https://tinyurl.com/androidevacuationchecklist) More detailed information can also be found at: https://www.insurance.ca.gov/01-consumers/105-type/95-guides/03-res/index.cfm 74 Nonprofits that insure their organizations through Open Door Insurance Services will be receiving “dividend checks” totaling more than $19,700 in recognition of their length of continuous coverage as well as favorable claims experience. This is the 13th year in a row that the Nonprofits Insurance Alliance of California (NIAC) has issued dividends. Nonprofits looking for insurance should contact Open Door Insurance in Occidental at 707-874-2666 or check us out on social media @opendoorins

|

Media Inquiries(707) 874-2666 Archives

March 2024

Categories |

RSS Feed

RSS Feed